The latest quarterly Opinion Poll provides valuable insights into current trends and sentiment within the UK housing market, based on feedback from estate agents nationwide. This barometer highlights key shifts in buyer confidence, property supply levels, and price expectations, reflecting broader economic dynamics and seasonal trends.

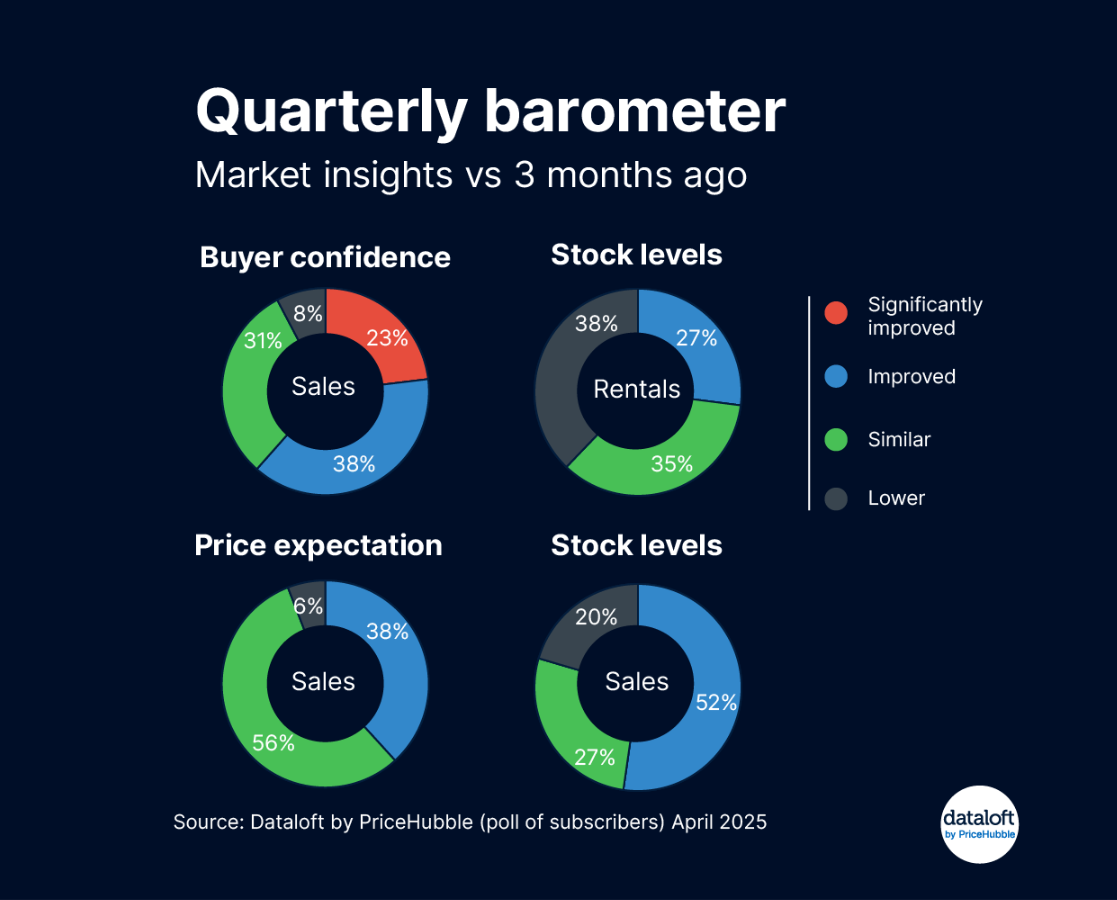

Recent decisions by the Bank of England to maintain interest rates at 4.5% during its second policy meeting this year have set a cautious tone amidst ongoing inflation concerns. Yet, despite economic uncertainty, the housing market remains notably resilient. According to the latest data, a significant majority (62%) of agents report that buyer confidence has improved over the past three months. This renewed optimism is indicative of buyers adapting to prevailing economic conditions and signals continuing demand in the face of relatively stable borrowing costs.

The spring season has traditionally marked a period of increased activity in the housing market, and this year is no exception. Over half (52%) of estate agents have observed a noticeable rise in housing stock availability. This increase represents the most significant boost in supply seen in a decade and points towards a highly competitive sales environment. Greater availability of properties is providing buyers with more options and encouraging active market participation.

With enhanced choice, however, comes heightened price sensitivity. The expanded inventory is tempering rapid price growth, as evidenced by market expectations for stability rather than significant increases. Indeed, a clear majority of agents (56%) forecast that property prices will remain consistent over the coming quarter, suggesting that buyers are now more discerning and market conditions are becoming more balanced. This equilibrium helps to maintain affordability and supports ongoing transaction activity, fostering a healthy and sustainable market dynamic.

The rental market is simultaneously experiencing distinct yet related trends. Demand for rental properties continues to rise, characterised by the usual seasonal uptick seen in springtime. However, this growing demand contrasts sharply with available supply. A significant 38% of agents report lower rental stock levels compared to earlier in the year. This tightening supply is exerting upward pressure on rents and could potentially heighten competition among prospective tenants.

Overall, the latest insights from the quarterly Opinion Poll depict a robust and active housing market, adapting effectively to prevailing economic pressures. While sales activity is buoyed by increased supply and stable prices, the rental market faces a contrasting scenario of escalating demand amidst diminishing stock. As we move into the next quarter, close monitoring of these dynamics will be crucial to understanding the trajectory of the UK housing market.

(Source: Dataloft by PriceHubble, Rightmove poll of subscribers, April 2025.)

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.