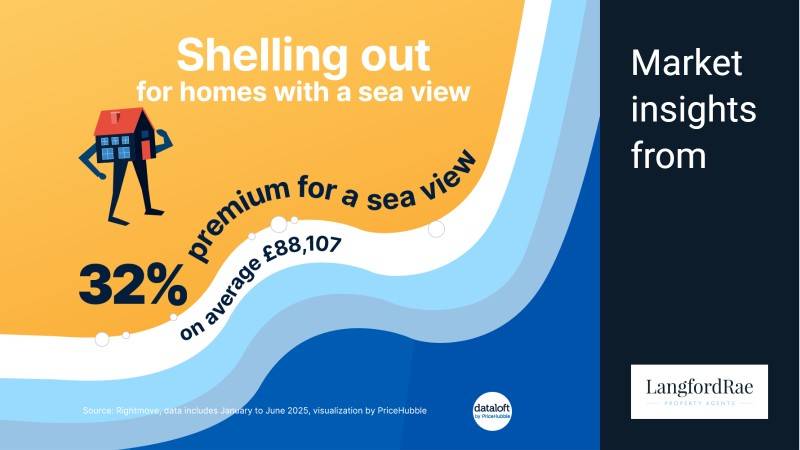

Source: Rightmove, data includes January to June 2025, visualization by PriceHubbleFor many buyers, waking up to the sight and sound of the sea isn’t just a dream-it’s something they’re willing to pay handsomely for. According to fresh analysis by Rightmove, coastal homes with a sea view are priced, on average, £88,107 higher than similar properties without one. That’s a 32% premium, and in some regions, the gulf between sea and land is even wider.

The East Midlands currently leads the way, with sea-view homes commanding a remarkable 68% premium. It’s a surprising front-runner, given the traditional focus on the South Coast, but one that reflects growing demand for overlooked coastal areas. Not far behind, the South West-long favoured for its beaches and relaxed pace-sits at a 44% premium, while Scotland, with its dramatic coastline and island views, follows closely at 43%.

It’s not just about aesthetics. Sea-view homes offer a lifestyle that many now covet: open skies, sea air, and a connection to nature that’s hard to replicate inland. The pandemic years changed how we view our homes. With hybrid and remote working now embedded in many people’s lives, buyers are no longer tied to commuter belts. Instead, they’re seeking space, tranquillity, and a daily dose of natural beauty-something a sea view delivers in abundance.

This emotional connection is underpinned by sound financial reasoning. Sea-facing properties are widely regarded as resilient long-term investments, precisely because of their scarcity. There’s only so much coastline, and planning restrictions often limit new development along it. That rarity keeps values buoyant even in cooler markets. From retirees downsizing with capital to spend, to second-home buyers and investors in the holiday let market, competition is fierce. Sea views often equate to higher occupancy rates and stronger nightly yields, especially in tourist-heavy regions.

That said, coastal living isn’t without its challenges. Buyers must factor in the realities of weather exposure, higher insurance premiums, and the ongoing threat of coastal erosion in certain areas. Salt air can be harsh on property exteriors and windows need more frequent upkeep. Yet these are often viewed as acceptable trade-offs for the lifestyle and prestige associated with owning a home by the water.

Interestingly, it’s not just the usual suspects like Cornwall or Dorset seeing increased interest. Seaside towns along the Lincolnshire coast, East Yorkshire, and Fife in Scotland are emerging as attractive alternatives-offering a better balance of affordability and lifestyle appeal. These areas provide access to the same sea air and morning views, often at a fraction of the price of more well-known destinations.

All told, the market is clear: Britons are still willing to shell out for that glimpse of blue on the horizon. Whether it’s the health benefits, the investment potential, or simply the peace that comes with watching waves roll in from your own window, homes with a sea view continue to outperform-and their appeal shows no sign of drying up.

Source: Rightmove, data includes January to June 2025, visualization by PriceHubble

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.