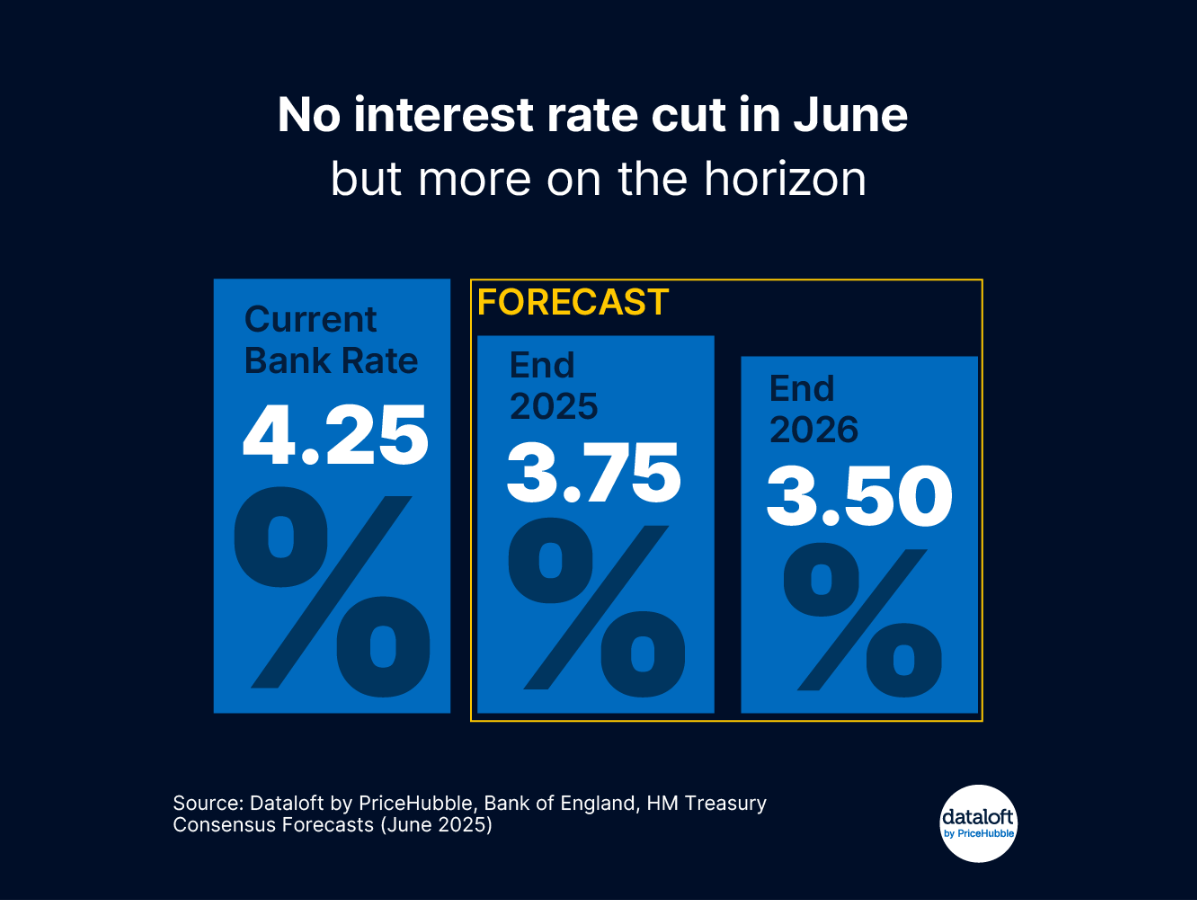

The Bank of England held its base interest rate steady at 4.25% following its June meeting just over a week ago, resisting mounting pressure to cut rates amid persistent inflation and ongoing geopolitical uncertainty. This decision, while anticipated by many analysts, leaves borrowers and the UK housing market waiting a little longer for relief from higher borrowing costs. However, the Bank has signalled that rate cuts are likely on the horizon, with the next opportunity coming as soon as 7th August.

The Monetary Policy Committee’s decision was not unanimous, reflecting growing divisions within the Bank. Six members voted to maintain the rate, while three advocated for a cut to 4%. The main rationale for holding steady was the continued presence of inflationary pressures, with the Consumer Prices Index (CPI) registering 3.4% in May - still well above the Bank’s 2% target. While this marks a slight improvement from April’s 3.5%, the Bank’s own forecasts suggest that inflation could rise again, potentially reaching 3.7% by September before gradually easing in 2026.

A significant factor behind the Bank’s caution is the recent escalation of geopolitical tensions in the Middle East. These events have driven oil prices up by over 13% in recent weeks, with gas prices rising nearly as much. Higher energy costs are expected to filter through to consumers, potentially pushing up household energy bills by around 3% this autumn if current price levels persist. Such increases threaten to keep inflation elevated, complicating the Bank’s task of returning it to target.

Despite these headwinds, there are growing expectations that the Bank will begin to cut rates later this year. The latest consensus economic forecasts, including those from HM Treasury and Dataloft by PriceHubble, point to two further 0.25% cuts by the end of 2025, which would bring the base rate down to 3.75%. Looking ahead to 2026, forecasts suggest a further reduction to 3.5% by year-end, provided inflation continues to moderate and economic growth remains subdued. The MPC’s recent voting patterns highlight a growing split, with a vocal minority now pushing for faster and more aggressive easing. New member Alan Taylor, for example, has argued that the UK economy is vulnerable to global shocks and would benefit from earlier rate reductions.

For the UK housing market, the decision to hold rates comes at a time of cautious optimism. After a period of volatility linked to changes in Stamp Duty Land Tax thresholds, house prices rose by 0.5% in April, with annual growth reaching 3.5%. Early indicators from May suggest that market activity is picking up, with both Zoopla and Rightmove reporting the busiest May for sales agreed in four years. However, the number of completed sales remains subdued, reflecting ongoing buyer caution and the lingering impact of higher mortgage rates. While rates have eased from their recent peaks, they remain elevated compared to pre-pandemic levels, and many households are still sensitive to changes in the cost of borrowing.

The Bank of England now faces a delicate balancing act. On one hand, it must guard against the risk of inflation becoming entrenched, especially given the unpredictable nature of global energy markets. On the other, it is under increasing pressure to support a slowing economy and a housing market that is only just beginning to recover from recent shocks. With the next MPC meeting scheduled for August 7th, attention will turn to the latest inflation data and developments in global markets. Should inflation show sustained signs of moderation and if economic growth continues to lag, the stage appears set for the Bank to begin easing rates - offering some much-needed relief to borrowers and the wider housing market.

For now, the message from Threadneedle Street is one of patience and caution. While the era of ultra-low interest rates may be over, gradual and measured cuts remain firmly on the horizon. The coming months will be critical in determining whether the Bank can successfully negotiate the twin challenges of stubborn inflation and a fragile economic recovery, and whether the long-awaited relief for homeowners and buyers will finally materialise.

Source: Dataloft by PriceHubble, Bank of England, HM Treasury Consensus Forecasts (June 2025)

Photo by Oli: https://www.pexels.com/photo/people-walking-on-pedestrian-lane-near-high-rise-buildings-6477567/

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.