First-Time Buyers Make a Comeback – What Does This Mean for the Rest of the Market?

After a challenging period in the property market, first-time buyers are making a strong return, reversing the slowdown seen in 2023. The last two years have been particularly tough for those trying to step onto the ladder, as soaring mortgage rates, high inflation, and the cost-of-living crisis created significant financial hurdles. The sharp rise in interest rates following the mini-budget in late 2022 led to higher monthly repayments, making mortgages less affordable for many prospective buyers.

In response to this uncertainty, many first-time buyers chose to delay their purchases, either staying in rental accommodation or living with family for longer in an attempt to save a larger deposit. Others found themselves priced out entirely, as lenders became more cautious, reducing borrowing limits and tightening affordability criteria. These factors contributed to a drop in first-time buyer transactions in 2023 compared to the peak levels of 2022.

However, as we move into 2025, conditions have started to improve. The stabilisation of interest rates has provided much-needed confidence, allowing first-time buyers to plan their finances with greater certainty. Mortgage lenders have responded by reintroducing more competitive products, including lower fixed-rate deals, making borrowing more manageable. Additionally, while house prices have remained relatively high, some areas have seen a softening of values, which, combined with wage growth, has made homeownership more achievable for some buyers.

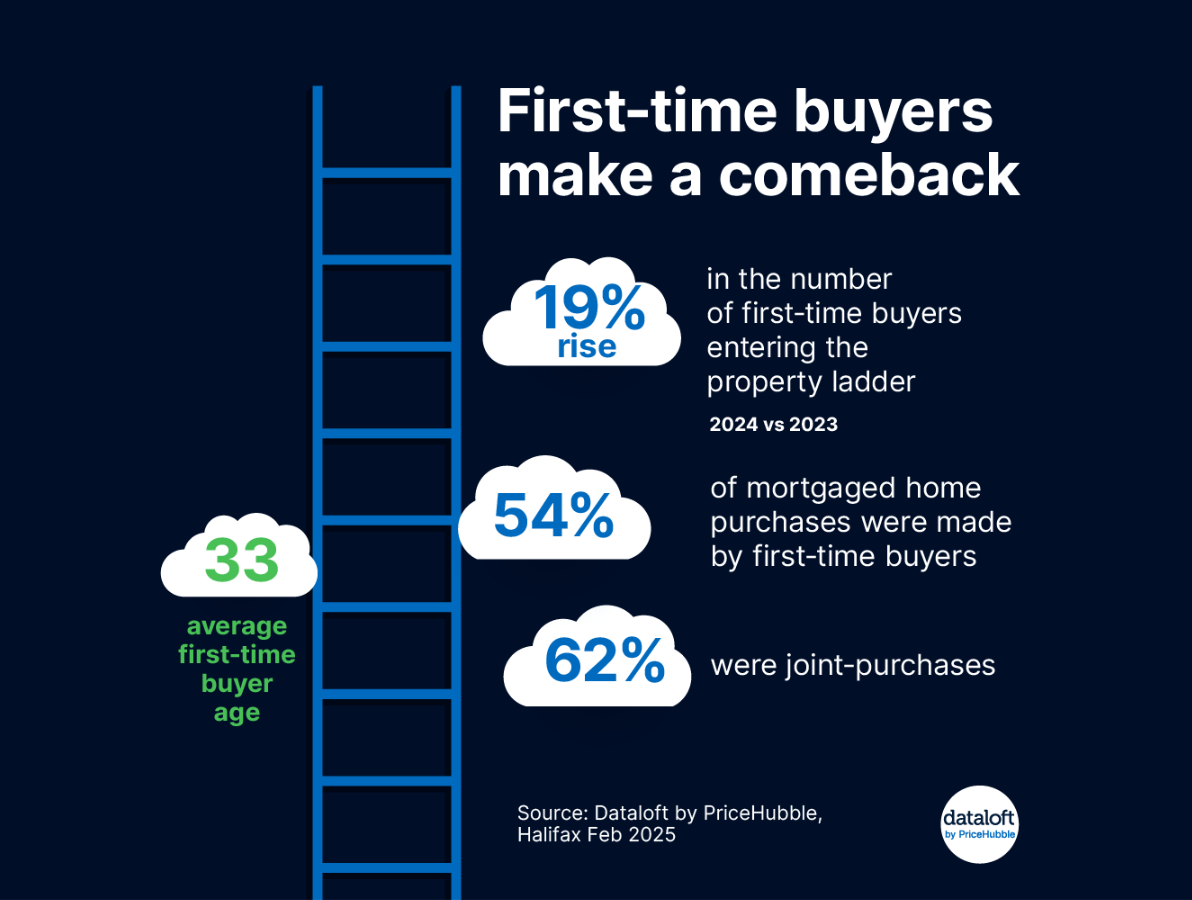

This renewed confidence is reflected in the latest figures, showing a nearly 20% increase in first-time buyer purchases compared to 2023. With demand for homeownership still strong and mortgage products becoming more accessible, first-time buyers are once again driving momentum in the housing market—an encouraging sign for sellers looking to move this year.

Demand for homeownership remains high, with first-time buyers now making up 54% of all mortgaged purchases—the highest proportion on record. This proves that despite affordability challenges, the aspiration to own a home remains strong.

Another notable trend is the increasing reliance on joint applications. Nearly two-thirds (62%) of last year’s first-time buyer mortgage completions were joint purchases, highlighting how couples and co-buyers are teaming up to tackle rising property costs. Meanwhile, solo buyers still account for a significant 38%, a slight increase from the previous year.

For those already on the property ladder, particularly in more affluent areas like Orpington and Sevenoaks, the resurgence of first-time buyers is a very encouraging sign. The property market functions as a chain, meaning activity at the lower end of the market often facilitates movement higher up.

When more first-time buyers enter the market, it creates opportunities for second-steppers—typically those moving from a smaller starter home to a larger family property. This, in turn, fuels demand for detached houses, period homes, and premium properties in desirable locations.

For homeowners looking to sell in 2025, this increased activity among first-time buyers could mean faster sales, as a more fluid market at the entry level often leads to fewer delays in property chains. It could also result in stronger demand, as more buyers securing mortgages leads to greater competition across price points. Additionally, a stable influx of buyers may support house prices, particularly in sought-after areas.

While first-time buyer confidence is improving, a key change in the land tax system could shake things up. From 1st April 2025, the threshold for first-time buyer stamp duty relief will revert from £425,000 to £300,000, with relief available only on purchases up to £500,000.

This change has created a short-term rush over the past few months, with first-time buyers eager to complete purchases before the deadline to take advantage of the higher threshold.

This deadline may result in a temporary slowdown in first-time buyer activity post-April, as some prospective buyers reassess their affordability. However, in areas like Sevenoaks and Orpington, where family homes and larger properties are in steady demand, the impact is likely to be minimal in the long run.

Looking ahead, the first-time buyer resurgence should help stabilise the market after a volatile couple of years. However, affordability remains a challenge, particularly as house prices have remained relatively high while wages have struggled to keep pace.

If you’re curious about how much your home is worth in the current market, Langford Rae Property Agents can provide expert guidance. Call us on 01689 862770 or use our free online valuation tool by clicking here, to get an instant estimate.

Whether you’re looking to upsize, downsize, or simply explore your options, understanding the value of your property and what work you may need to undertake to make your property market ready is the first step toward making the most of 2025’s property opportunities.

* Statistics from PriceHubble, Halifax

* Image by prostooleh on Freepik

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.