In recent years, the UK housing market has undergone a notable shift, presenting first-time buyers with a unique opportunity. Historically, renting was often seen as the more affordable option compared to purchasing a home. However, with rental prices surging across England and Wales, homeownership has now emerged as the more cost-effective choice.

In recent years, the UK housing market has undergone a notable shift, presenting first-time buyers with a unique opportunity. Historically, renting was often seen as the more affordable option compared to purchasing a home. However, with rental prices surging across England and Wales, homeownership has now emerged as the more cost-effective choice.

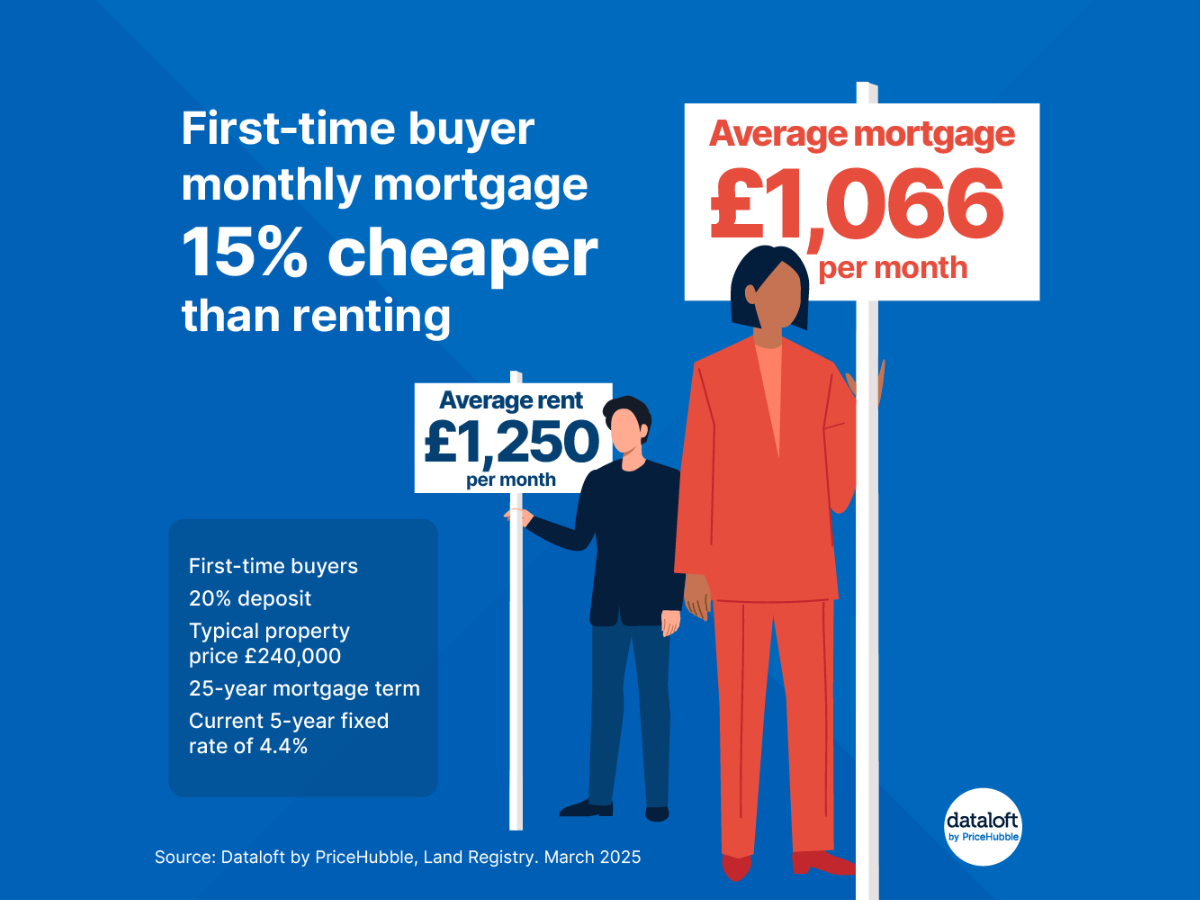

As of early 2025, the average monthly rent stands at £1,250, a sharp increase that has made renting significantly more expensive. Meanwhile, a first-time buyer purchasing a property valued at £240,000 with a 20% deposit (£48,000) and securing a 25-year mortgage at a 5-year fixed rate of 4.4% would face monthly mortgage repayments of approximately £1,066. This represents a 15% reduction in housing costs compared to renting, making buying a more attractive financial decision for many.

One of the primary drivers behind this shift is the decline in mortgage interest rates. After reaching a peak in mid-2023, mortgage rates have since fallen by around 10%, reducing borrowing costs and increasing affordability. Government initiatives aimed at supporting first-time buyers have also played a role, with adjustments to schemes such as the Lifetime ISA providing more incentives for those looking to enter the property market.

Despite the apparent financial advantage of buying, affordability challenges persist. The ability to save for a deposit remains one of the biggest barriers to homeownership. A 20% deposit on an average-priced first-time buyer property requires £48,000—a daunting sum for many, especially amid rising living costs. In response, policymakers more recently made revisions to stamp duty thresholds and other measures to ease the financial burden on buyers. This threshold adjustment, however, is due to change on 1st April 2025.

Regional differences also influence whether buying is a better option than renting. In London and other high-rent areas, the financial benefits of homeownership can be even more pronounced. In contrast, regions with lower rental costs may see a smaller gap between mortgage and rental payments, making the decision more dependent on individual circumstances, job stability, and long-term plans.

The market's current conditions highlight a compelling case for first-time buyers to consider purchasing rather than renting. With mortgage rates stabilising and rental prices continuing to climb, the opportunity to secure a home with lower monthly costs has never been more relevant. However, prospective buyers should carefully assess their financial situation, explore available government schemes, and seek expert guidance to ensure they make informed decisions about stepping onto the property ladder.

Source: Dataloft by PriceHubble, Land Registry. March 2025

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.