For decades, property investment has been a cornerstone of wealth-building in the UK. The allure of bricks and mortar is clear—property values have historically outpaced inflation, and homeowners can enjoy capital gains on their primary residences without tax burdens. However, the buy-to-let industry has shifted significantly.

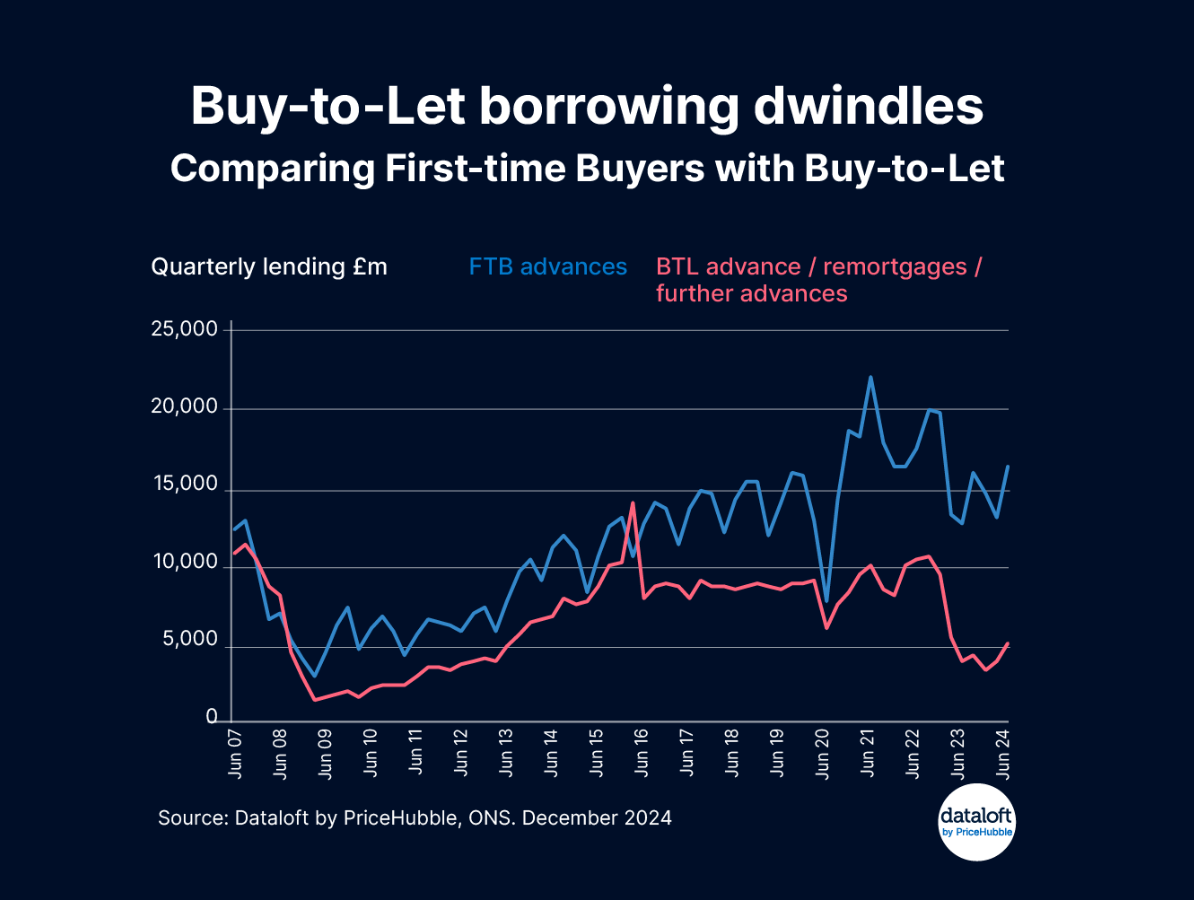

Changes to tax policy, rising interest rates, and shifting government incentives have created an increasingly challenging environment for landlords. Meanwhile, first-time buyers (FTBs) continue to benefit from tailored incentives, even as they face their own hurdles. These dynamics are driving a growing divide in borrowing volumes between first-time buyers and buy-to-let investors.

The Decline of Buy-to-Let Borrowing

The buy-to-let sector, once a powerhouse of the UK property market, has been hit by a series of policy and market shifts. Among the key changes:

- Eroded Tax Benefits: The ability to offset mortgage interest payments against rental income for tax purposes—a cornerstone of buy-to-let profitability—has been significantly curtailed in recent years. Now, landlords face steeper tax bills, diminishing the appeal of property as an income-generating investment.

- Higher Stamp Duty Rates: Buying additional properties comes with a 5% stamp duty surcharge as of the latest Autumn Budget. This is a sharp increase from the previous 3%, further discouraging prospective landlords.

- Rising Interest Rates: Interest rates have climbed steadily, making buy-to-let borrowing more expensive. While homeowners are also affected by higher rates, landlords face the dual challenge of reduced profitability on their rental income and increased borrowing costs.

Is Buy-to-Let Worth It?

For many, buy-to-let is no longer the golden ticket it once was. Increased costs, regulatory hurdles, and modest rental yields in some areas are prompting investors to reevaluate.

That said, buy-to-let can still make sense in certain circumstances:

- Long-Term Capital Growth: Property remains a valuable asset for long-term wealth building. Investors who can afford to weather short-term fluctuations may still see significant gains over decades.

- Strong Rental Demand: The UK continues to face a housing shortage, keeping rental demand high. For properties in high-demand areas, landlords can still command competitive rents.

- Diversification: For those with a diverse portfolio, property can be a solid hedge against inflation.

However, for landlords reliant on immediate rental income or leveraging heavily with mortgages, the current environment is challenging. Many may find their returns eroded by rising costs and taxation.

Why Are Landlords Selling Up?

A growing number of landlords are exiting the market, selling properties instead of retaining them as rental investments. Key reasons include:

- Diminished Profitability: Rising interest rates, coupled with higher tax burdens, mean many landlords see diminishing returns.

- Increased Regulation: From energy efficiency standards to tenant protections, compliance costs are rising, creating further disincentives for landlords.

- Capital Gains Realisation: With property prices still relatively high in many areas, some landlords are choosing to cash out and realise their capital gains rather than waiting for potential market downturns.

- Opportunities in Other Investments: With fixed-income products like bonds offering better returns in the current interest rate environment, some investors are shifting their focus away from property.

First-Time Buyers Holding Steady

Despite rising interest rates, first-time buyers have remained relatively active in the market. This resilience can be attributed to several factors:

- Incentives for Buyers: Stamp duty concessions and past initiatives like Help to Buy have enabled many young buyers to get on the ladder.

- Parental Support: The so-called "Bank of Mum and Dad" continues to play a significant role in helping first-time buyers gather deposits, easing their entry into the market.

- Priority Borrowers: Unlike buy-to-let investors, first-time buyers often receive more favourable lending terms, making it easier for them to secure mortgages even in a higher interest rate environment.

What Percentage of UK Mortgages Are Buy-to-Let?

As of 2024, buy-to-let mortgages represent around 15% of the UK’s mortgage market, a figure that has been declining steadily over recent years. This reduction reflects the challenging environment for landlords, with many either downsizing their portfolios or exiting the sector entirely. Conversely, the proportion of mortgages for first-time buyers and primary residences has remained stable, supported by ongoing demand and tailored government incentives.

Looking Ahead

The UK property market is undergoing significant changes, with buy-to-let borrowing dwindling as first-time buyers maintain their foothold. For prospective landlords, 2025 will be a year of careful consideration. The rising costs and increased regulation make it critical to evaluate the profitability of new investments.

For first-time buyers, it is still a challenging process but offers opportunities, especially with family support or strategic use of incentives. As always, a clear understanding of the local market is essential.

At Langford Rae Property Agents in Chelsfield, we are committed to helping both investors and buyers navigate the evolving property market. Whether you're considering a new investment or taking your first step on the property ladder, our team is here to guide you.

Source: Dataloft by PriceHubble, ONS. December 2024

Image by wayhomestudio on Freepik

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.